7 Simple Techniques For Life Insurance Online

Table of ContentsThe 6-Second Trick For Cancer Life Insurance

depends on your specific demands. A term life policy makes good sense if you believe you only will need coverage for a duration. Term life additionally often tends to be a lot more cost effective than entire life, so it can make feeling for those concentrated on staying within a budget plan. "Term insurance coverage visit our website is great for somebody who has an insurance coverage need for only a set number of years,"says Jason Wellmann, elderly vice head of state of life distribution at Allianz Life.

Whole life insurance additionally makes feeling for those who intend to lock in one premium price as well as maintain that price for as lengthy as they live."The death benefit remains in position for the whole life time of the guaranteed, as long as adequate costs are paid, "Wellmann states. Entire life likewise offers a" money worth"account that charms to those wishing to collect a bigger pool of cost savings. You can access cash value in the form of a loan or withdrawal from the cash worth. The cash could be made use of for points such as: Helping with a kid's university education and learning, Financing retirement income, Paying for emergency situation expenditures, How to pick a life insurance policy coverage quantity? You may wonder,"Just how much life insurance policy do

I require?" When acquiring life insurance policy, selecting the right quantity can be tough. Some specialists recommend buying an advantage that will certainly pay 7 to 10 times an insurance policy holder's yearly income. Working closely with a life insurance policy agent can help you figure out just how much coverage you need given your special scenario. Life insurance quote online. Just how much does life insurance cost?Average life insurance cost is a little bit of a misnomer because the cost of a life insurance policy policy can differ extensively by person. Ladies live longer, so they tend to pay reduced costs. Much healthier individuals pay lower premiums than those with some medical problems. You will certainly pay higher costs if you smoke. Individuals with risky leisure activities-- such as sky diving-- may pay higher costs. Jobs that include even more physical threats can lead to higher costs. If you're looking for inexpensive life insurance, know that term life protection is

usually typically less costly whole life coverage. Just how to save on life insurance policy? The very best life insurance plan is the one that totally fulfills your needs. Investing in life insurance policy is constantly a balancing act in between getting the insurance coverage you need and also getting the most effective life insurance policy prices."Recognize what is crucial to your financial strategy as well as evaluate every year."Another crucial method to save is to compare life insurance rates. This way, you can find the finest policy at the ideal price. Exactly how to obtain life insurance quotes? You have numerous alternatives for getting life insurance coverage quotes. One method is to narrow a list to a number of insurance providers and also to acquire specific quotes from each of them, either by calling their offices or utilizing their web site

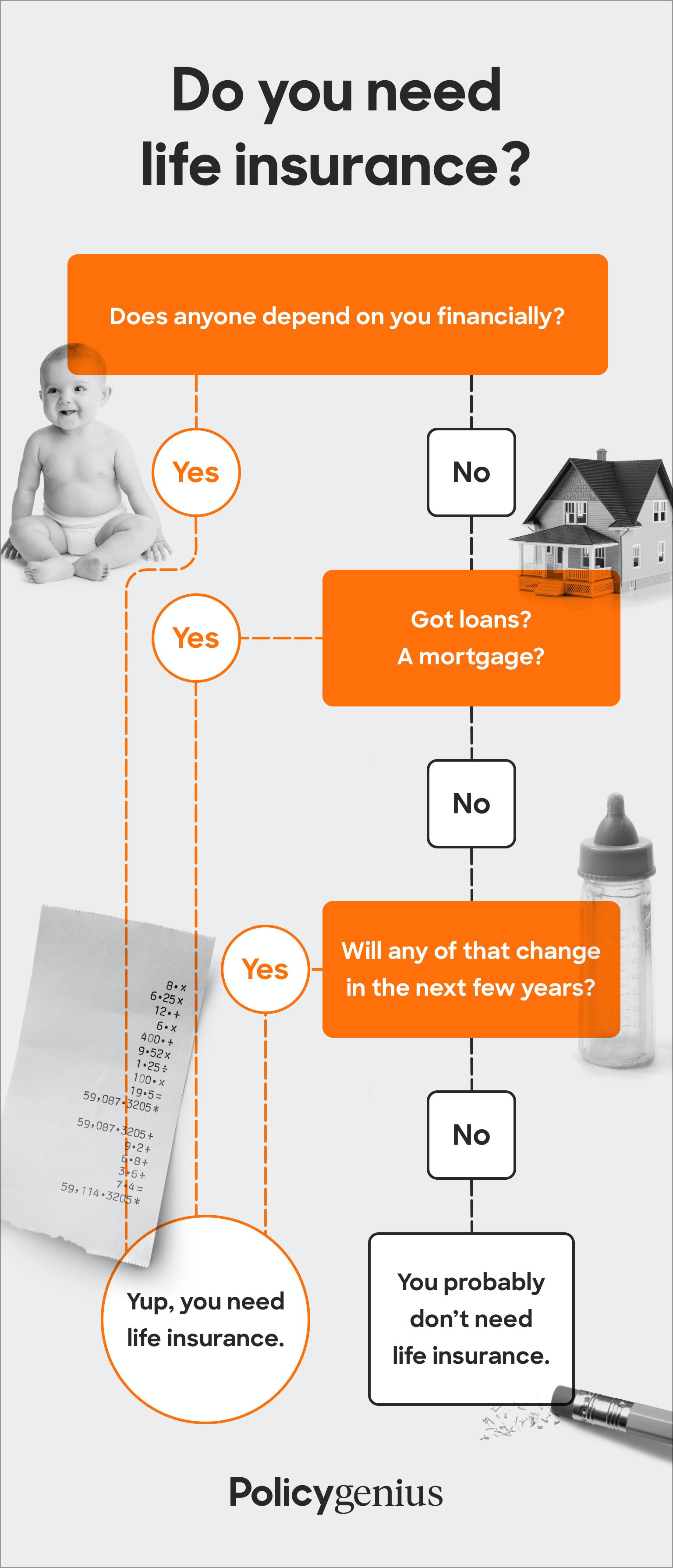

. Obtaining life insurance coverage prices estimate online is just one of the finest methods to conserve. One of the most basic and quickest methods to collect quotes is to utilize a service like the one provided by Simply type in your postal code and you will rapidly get numerous life insurance prices quote in simply a few minutes. Here are some concerns to address: Do you have liked ones depending on your earnings for their health? Is there a favorite charity or cause you want to support financially? Do you wish to give cash to cover your final expenses? Depending on your objectives, you might designate one or more people to be recipients. Choices may consist of: Every one of the death benefits arrive in a single payment (Life insurance quote online). Some recipients locate it much easier to get the cash gradually over a duration. Some insurance providers might enable a recipient to keep the survivor benefit

in an interest-bearing account. Recipients can then compose checks against the cash in the account. Unless the annuity is developed for a set period, any kind of remaining fatality advantage remaining when the beneficiary passes away will return to the insurance provider. Kentucky Farm Bureau. Just how does a recipient make an insurance claim? The Insurance coverage Details Institute advises